AGA: The State of the States

Commercial gaming is stronger than ever, according to the American Gaming Association, which released its 2024 State of the States Report this week.

Coming hot on the heels of the market's 13th consecutive quarter of growth, the research showed that:

- Commercial gaming revenue reached a record $66.66 billion in 2023, 10.3% higher than in 2022.

- 30 of 36 states set annual records for commercial gaming revenue.

- Commercial gaming operations generated $14.67 billion in direct gaming tax revenue paid to state and local governments, not including billions more paid in income, sales, or other taxes. This is a 9.7% increase YoY.

- In 2023, 32 of the 36 jurisdictions with commercial casinos, iGaming, or sports betting operations saw a rise in annual gaming revenue, with only the District of Columbia, Florida, Indiana, and Mississippi contracting.

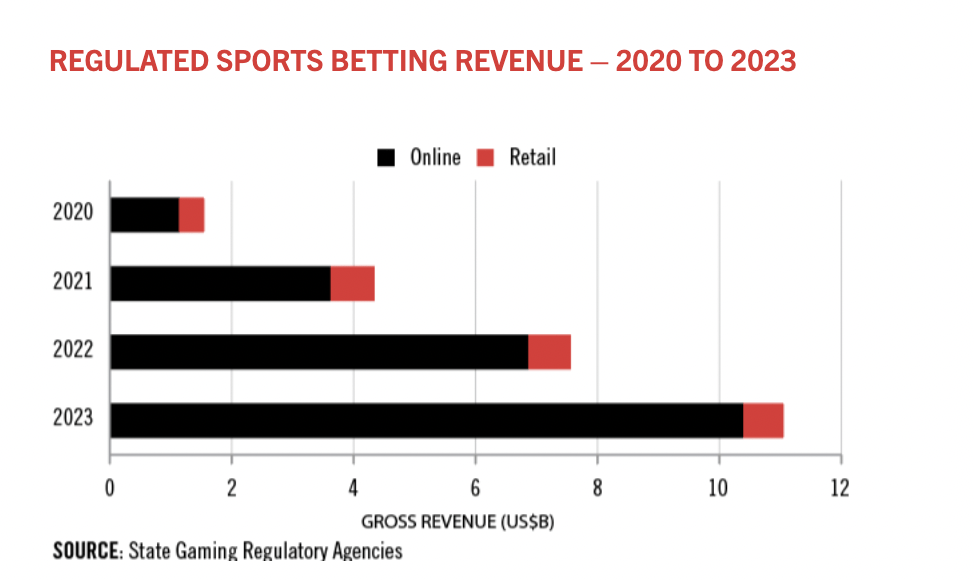

- Sports betting saw a 46% YoY increase, with Ohio, Massachusetts, Nebraska, Kentucky, and Maine joining the legal side of the market. This caused revenue to skyrocket from $7.56 billion in 2022 to $11.04 billion in 2023.

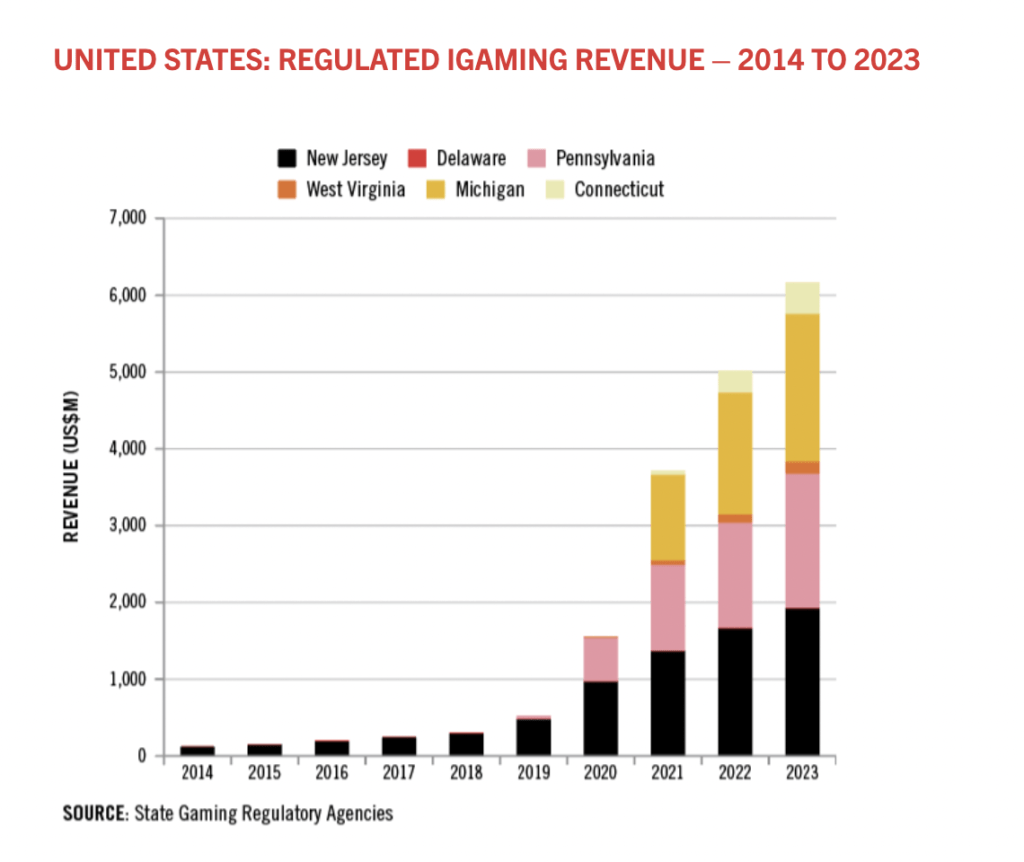

- The six (now seven) iGaming states continued their “explosive growth,” making US$6.17 billion in revenue, +28.2% YoY.

Overtime, both sports betting and iGaming revenue have shown incredible growth in states that have legalized them.

Delaware Opening or Still a Stale Hope?

HB 365, which seeks to open Delaware’s sports betting market to operators, has progressed to the House Appropriations Committee. Estimates have said that if the market is allowed to expand, the handle could top US$186 million in FY25, with a compound annual growth rate of 5% after that.

The current handle for FY23, which includes the four months Rush Street Interactive (RSI) has been operating as the state’s sole online sportsbook provider, has shown promising figures: US$65.3 million. The online sportsbook launched shortly after RSI took over from 888 as Delaware’s exclusive online gambling provider.

The bill would allow each of the state’s three racecourses to operate two online skins. Licenses would cost US$500,000 and last for five years. Revenue would be taxed at 18%—a steep decline from the current rate of 50%.

Delaware has had a restricted market since it launched online gambling in 2013. Until the start of 2024, 888 Holdings was the sole online platform. The current laws in Delaware state that the first US$3.75 million of online gaming revenue is given straight to the state, after which revenue is taxed at 62.5%

Delaware broke this benchmark for the first time in 2018, meaning it was a profitless market for the first five years. This week, HB 365 was reassigned to the House Appropriations Committee after it saw no progress at the House Administration Committee.

Like other interested parties, we will patiently wait to see if there is any more movement before the close of this year’s legislative session in Delaware.

WSOP.com Launches

WSOP has launched the first online shared liquidity cross-state poker network this week. Accepting players from Michigan, Nevada, and New Jersey it brings to life the essence of the Multi-State Internet Gaming Agreement.

The platform went live on Tues. Caesars Digital Vice President of Online Poker Danielle Barille said, “This platform upgrade is long overdue and is a big win for our players.”

“The best is yet to come for WSOP Online tournaments, and we’re thrilled to bring Michigan players into the fold with Nevada and New Jersey, resulting in a better experience, more value, and the biggest prize pools of the year.”

Alongside pooled prize pots, the prospective player pool is massive: MI has a population of 10M, NJ 9.3M, and NE 3.2 M.

evoke (888) US Exit Continues

It’s been reported that evoke has said it will complete its Michigan exit of the SI brand by Q4 2024. The move comes after the brand failed to grasp even 1% of the Michigan market share in each month of Q1 2024.

evoke, rebranded from 888 Holdings, is exiting the entire US market (not long after its Delaware exit at the start of the year) after announcing a strategic new corporate plan that doubles down efforts in its key markets—the UK, Spain, Italy, and Denmark.

evoke's exit marks the latest company to fold under the US market's high pressures, which include strong consumer brand loyalty and costly acquisition.